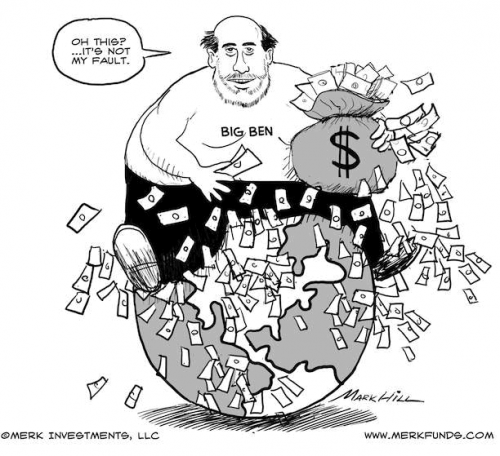

Today is the last day for Ben Bernanke as Fed-president. A dutch newspaper called him the best president ever. He saved the world from a meltdown in 2008, they claim. Only the opening of the dollar floodgates at the American central bank prevented a financial meltdown.

When the former Fed-president, Alan Greenspan, left office in 2006, there was really no doubt in anybody’s mind about whom was the best Fed-head ever. Greenspan was, he was called the Maestro. In the years that he had led the Fed every small crisis had been faced with immediate action. The lowering of interest rates by the Fed was enough to lift anyone’s mind up again.

And then the real crisis hit. One can start to doubt internet companies and nothing really serious happens. One can start to doubt industry and there will be a little hiccup in economic growth, but when one starts to doubt banks, it is like a game of dominoes. When the first one falls, one knows there is another one to come. And without rigorous action also the last bankdomino will fall.

Central banks reacted well, facing the crisis. Not only the Fed, but also the Bank of England, the ECb and the central bank of China. But it wasn’t only monetary authorities that mattered. The governments of the US, Europe and China (and Japan, and india, and…) started spending.

The real question is, if it was not a little bit of overkill. Too much spending by governments, too much helicopter money by the Fed, an interest rate of 0% for way too long.

The price of this policy isn’t known yet. The policymakers of the flooding the system tactics have not made the same mistakes as the policymakers who faced the crisis of the thirties. But who knows if they have not made different ones, maybe even more serious ones.

Fact is that the world is overflooded with cheap money. To think that all this money will drain away without causing serious problems is trusting that there is a good sewer system in the world economy.

It probably won’t work that smoothly. Interest rates are too low now and have been too low for at last two decennia. That means that the whole current generation has been fooled into believing in an unrealistic low price of risk. And has been taking too big of risks as a consequence.

That will have too change. By the time when there is a decent growth rate at a moment when central banks interest rates are around 5%, and when those rates won’t be lowered at every hiccup of the economy, only then it is the right moment to go and judge Bernanke.

Personally I think a little more crisis would have been good. A good sickness helps to clean out the system. Don’t trust on medicine, the body will heal itself.

I know, I know, this would not have worked in september 2008. But now it is five years later, and we are still taking overdoses of drugs. That doesn’t sound very healthy, but let’s judge in a few years.

31 jan

Share

Patrick says

Totally agree. Typical journalism, to call someone the best ever on the day he leaves the job. History will judge, not a some hack.